At Cadmus, we partner with banking, insurance, and financial institutions to navigate today’s complex commercial, technological, and regulatory landscape. By combining deep subject matter expertise with advanced data analysis, we deliver tailored solutions in credit risk, market risk, compliance, governance, and operations. Our innovative, technology-driven strategies optimize operations, enhance customer experiences, ensure regulatory compliance, and accelerate digital transformation.

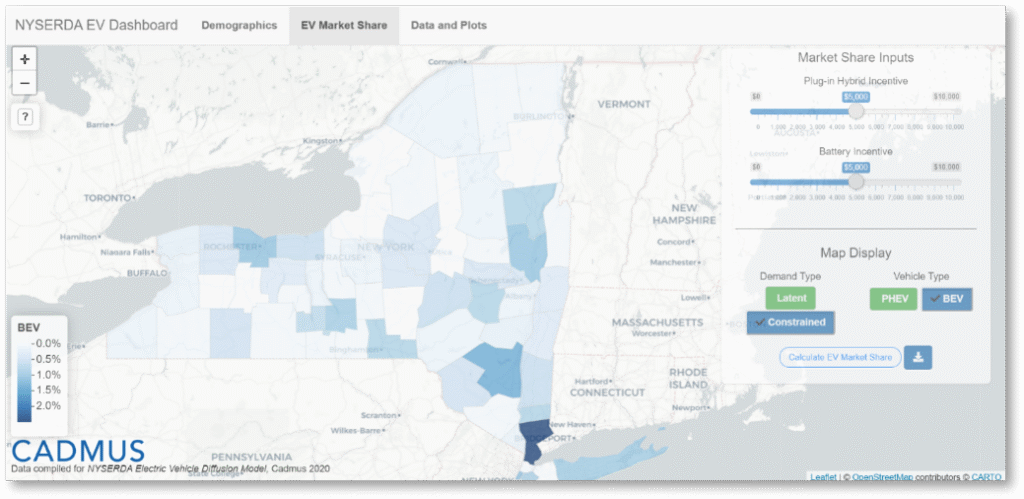

We design predictive analytics tools and real-time risk detection models for institutions to proactively address market and operational risks—such as Freddie Mac’s anomaly detection system.

We ensure consistent compliance with evolving credit loss regulations through advanced economic modeling and tailored governance frameworks.

We support leading financial providers in modernizing their digital infrastructure to streamline workflows, strengthen security, and deliver seamless, customer-focused experiences.

We leverage AI, ML, and automation to optimize decision-making, enhance operational efficiency, and future-proof financial systems.

With decades of industry experience and cutting-edge tools like AI, machine learning, and automation, we empower financial institutions to build resilient, future-ready systems that stay competitive in evolving markets.

Digital transformation is a business imperative for financial institutions seeking to capture market share and engage customers with mobile-friendly, self-service retirement options. Cadmus’ shared services approach boosted capacity and clarity at a Fortune 100 financial services provider. As a “translator” between business stakeholders and technology practitioners, Cadmus reduced friction and fostered mutual understanding, while helping ensure product owners get what they want right out of the gates.

By combining the right tools, strategies, and transformative technologies, we’re delivering comprehensive approaches that facilitate change and address the most critical problems facing our world today.

Our client work is often the first and largest of its kind—bar-raising, barrier-breaking, and goal-exceeding. Our dedicated experts are ready to help you achieve lasting results.